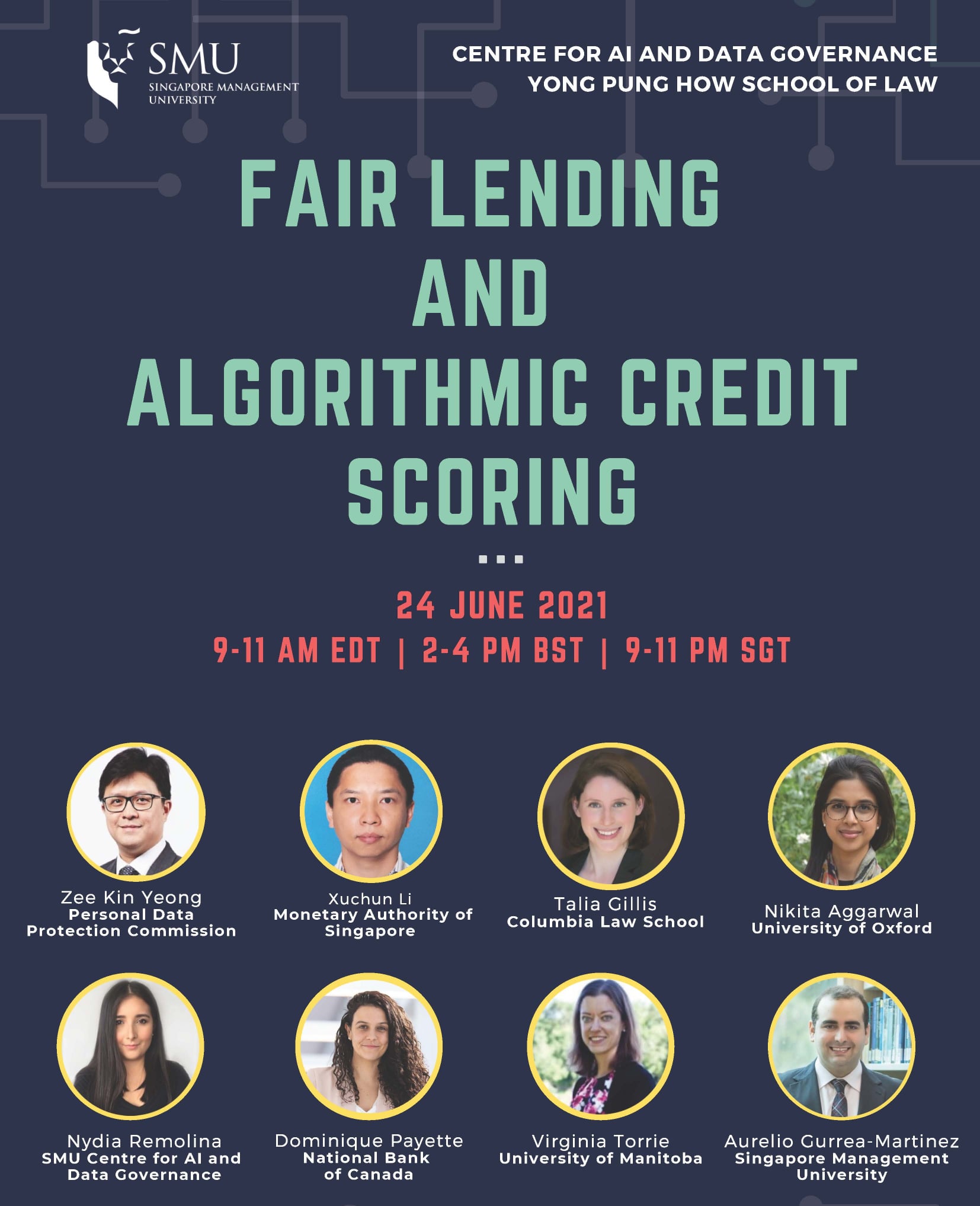

The use of artificial intelligence (AI) in lending markets may create many opportunities for consumers, financial institutions, and promotion of people’s access to finance. Despite these advantages, the use of AI for credit scoring and lending practices may create certain problems and challenges, especially in terms of biases, fairness, discrimination, and accurate pricing of loans. This webinar seeks to analyse, from a comparative and interdisciplinary perspective, the primary challenges that need to be addressed to promote an efficient and responsible use of AI in lending markets. For that purpose, scholars and policymakers from the United States, Canada, the United Kingdom, and Singapore will share their perspectives and recent work on fair lending, algorithmic credit scoring, and those policies potentially adopted to build a better AI Governance system in the context of financial institutions.

Last updated on 09 Mar 2022 .